What is Bitcoin? Why is everyone talking about it?

Bitcoin (BTC) is a type of digital currency, often referred to as “digital gold.” Unlike traditional paper money and coins, Bitcoin exists entirely on the internet. You can think of it as “electronic cash,” but it is more appealing than traditional money because it is not controlled by any government, bank, or institution—it’s entirely in the hands of its users.

Three Key Features of Bitcoin:

Decentralized: There is no central authority controlling Bitcoin; its operation relies on thousands of computer nodes around the world to maintain it.

Limited Supply: The total supply of Bitcoin is only 21 million, and it cannot be increased, making it as scarce as gold.

Transparent and Secure: All Bitcoin transactions are recorded on a public ledger (blockchain), which anyone can view, but cannot alter.

Bitcoin Halving and Its Relationship with Bull Markets

One of Bitcoin’s unique designs is its “halving mechanism” (Halving), which is a key factor affecting Bitcoin’s price and supply-demand dynamics. Approximately every four years, the reward for mining Bitcoin is halved. Historically, each Bitcoin halving has been followed by a significant bull market. Here is the relationship between Bitcoin halving and price trends:

2012, 1st Halving: The mining reward was reduced from 50 BTC to 25 BTC. After the halving, Bitcoin’s price increased from around $12 to over $1,000 the following year.

2016, 2nd Halving: The mining reward was reduced from 25 BTC to 12.5 BTC. After the halving, Bitcoin’s price rose from around $650 to nearly $20,000 by the end of 2017.

2020, 3rd Halving: The mining reward was reduced from 12.5 BTC to 6.25 BTC. After the halving, Bitcoin’s price surged from around $9,000 to $69,000 in 2021.

2024, Halving Effect Again: By 2025, Bitcoin’s price is expected to break $100,000 due to increased demand, making the halving effect a key catalyst for the next bull market.

This pattern is not accidental. The halving mechanism directly reduces the supply of new Bitcoin, while demand tends to remain stable or even increase. The changes in supply and demand drive the price upward. Therefore, many investors view Bitcoin halving as an important market signal, considering it a catalyst for the bull market.

Why Buy Bitcoin? What Can You Do With It?

1. Investment and Growth Potential

Although Bitcoin’s price can be volatile, its growth potential is undeniable. Since its creation in 2009, Bitcoin’s price has risen from a few cents to over $100,000. Many early investors have seen substantial returns, whether through trading cryptocurrencies for short-term profits or buying and holding for long-term gains. Many see cryptocurrency as a way to diversify their investment portfolio.

2. Full Control of Personal Assets

In traditional financial systems, banks control your money, but Bitcoin allows you to be your own bank. As long as you protect your private key (password), your Bitcoin will always belong to you and will not be controlled by any institution.

3. Cross-Border Payments with Speed and Low Fees

One major advantage of Bitcoin is its ability to make fast, low-cost cross-border payments. You can easily transfer Bitcoin to friends or merchants in any country, while traditional cross-border remittance methods often involve high fees and long processing times. In contrast, cryptocurrencies facilitate near-instant transfers and lower transaction costs.

4. Fight Inflation and Protect Wealth

Over time, many currencies depreciate due to “money printing,” leading to rising prices. Bitcoin, however, has a fixed supply and cannot be arbitrarily increased, making it an ideal store of value to help users combat inflation.

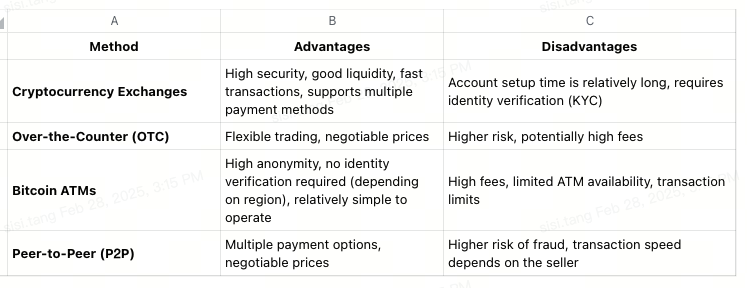

Bitcoin Purchase Channels and Their Advantages and Disadvantages

Why Choose OSL?

1. Compliant and Reliable Deposit/Withdrawal Channels:

As a licensed platform in Hong Kong, OSL provides secure and convenient deposit and withdrawal channels. The platform supports multiple payment methods, including bank transfers, FPS, eDDA, and wire transfers, and allows users to directly invest in HKD (Hong Kong dollars) and USD (US dollars). Whether you are a retail investor or a financial institution, OSL offers a flexible fund management experience.

2. Low Investment Costs:

OSL has no minimum investment threshold, meaning you can start investing in Bitcoin (BTC) with as little as HK$1. Retail investors also enjoy zero trading fees when using the “Fast Trade” feature, compared to other exchanges that charge transaction fees of 0.1% to 0.3%. This makes OSL an ideal choice for low trading costs.

3. Safe and Reliable Funds:

In addition to holding multiple licenses granted by the Hong Kong Securities and Futures Commission (SFC), OSL provides up to $1 billion in asset insurance, one of the highest coverage amounts in the industry. Furthermore, OSL regularly undergoes financial audits by the Big Four accounting firms to ensure transparency in operations and full protection of user funds.

How to Register and Start Trading on OSL

Opening an account and starting to trade on OSL is simple. Just follow these steps:

Step 1: Register your account and complete identity verification.

Step 2: Submit address proof (a utility bill or bank statement from the last 3 months).

Step 3: Verify bank transfer details.

Step 4: Start trading! Go to the “Trade” page, choose “Buy BTC” or other cryptocurrency, select HKD or USD, enter the amount, and click “Buy” to complete the transaction.